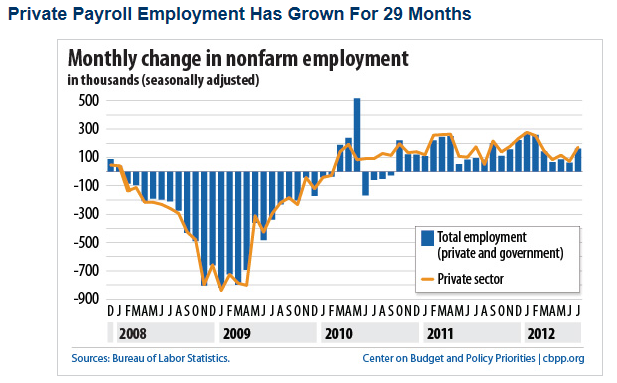

I know that I am not an economist but I did study math in Electrical Engineering and I did use math during decades of engineering work and my wife retired from the GAO as an auditor but our math is not adding up with regard to Romney’s tax and budget ideas. Here is the problem:

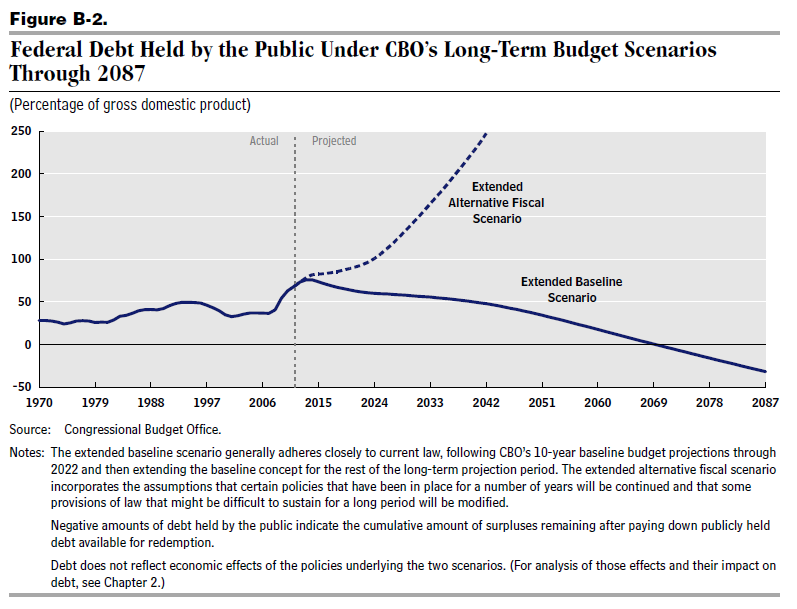

Romney has stated that he will make the Bush tax cuts permanent. The CBO estimates that this will cost the Federal Government 5.4 trillion dollars over 10 years (link).

Additionally, Romney states that he will cut 20% more across the board in all federal income tax rates, eliminating the Alternative Minimum Tax, eliminating the estate tax, reducing the corporate income tax rate and other tax reductions. This will cost another 5 trillion dollars in 10 years (link).

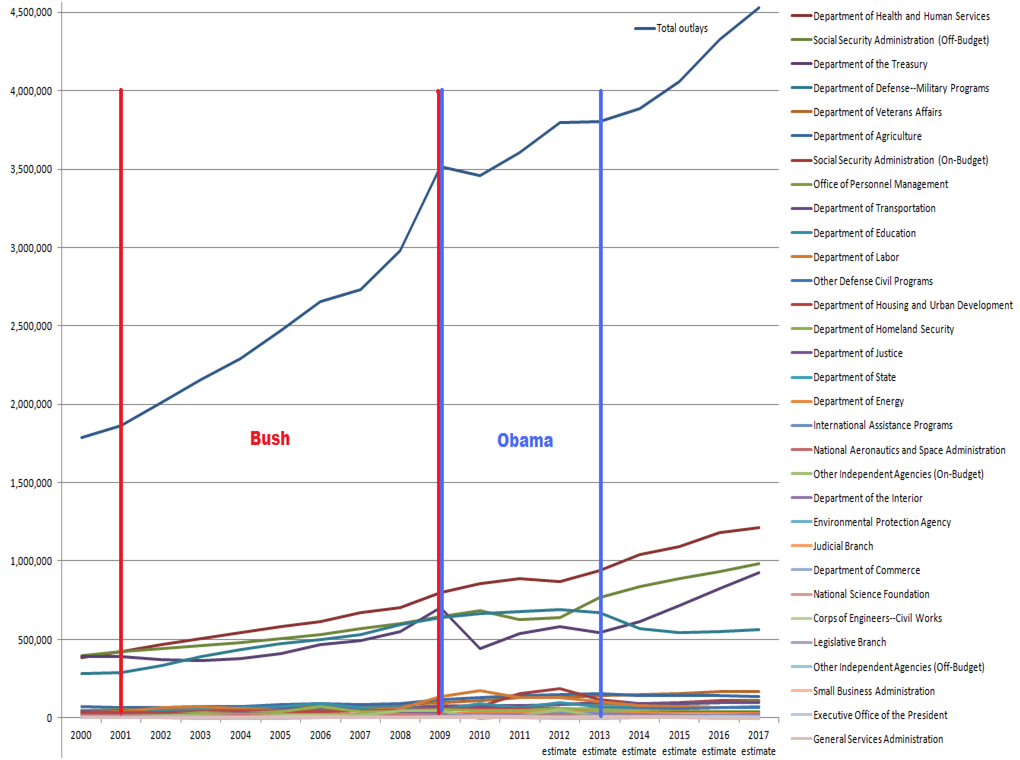

Romney has also said that he would increase defense spending by 2 trillion dollars over 10 years (link).

If you add all these numbers up you will get 12.4 trillion dollars in increased spending or revenue cuts over 10 years. The works out to about 1.24 trillion dollars a year.

Romney has stated that his cuts and spending will be deficit neutral. He plans to make up the difference by eliminating tax loopholes or deductions. If this is to be deficit neutral he will have to make up 1.24 trillion dollars a year by eliminating loopholes and deductions.

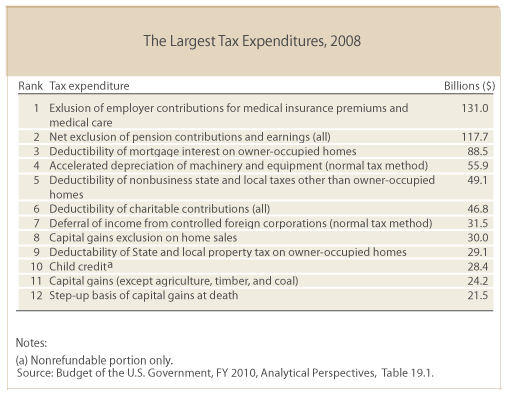

Here are the largest loopholes and deductions in the tax code.

The top 10 make up 70% of all tax deductions (link).

All 12 of these deductions amount to 653.7 billion dollars a year.

Therefore, we are still lacking 583.6 billion dollars a year to be deficit neutral after all 12 deductions are eliminated.

Romney has stated that he would cap the deductions at $17,000, $25,000, $50,000 or “make up a number” a year in order to be deficit neutral.

My questions are:

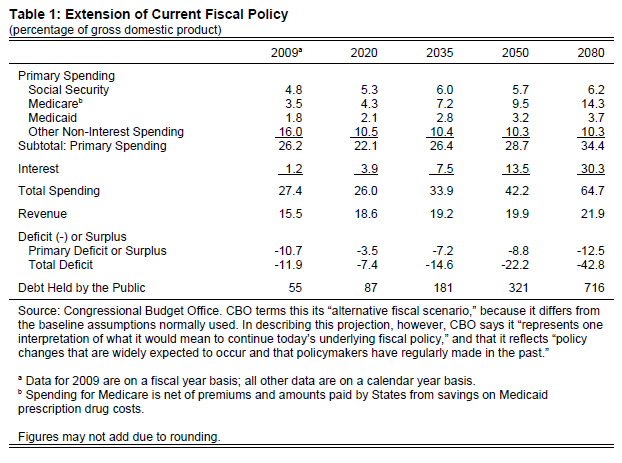

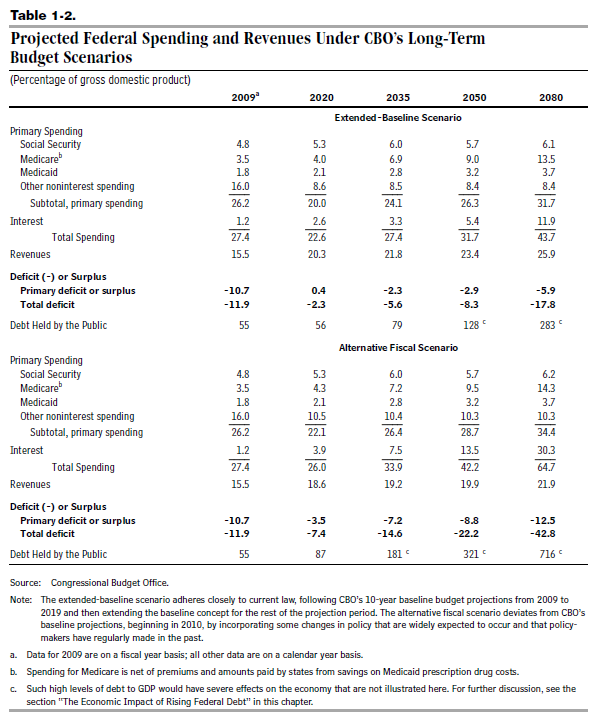

1) With all the tax deductions intact, where is the 1.24 trillion dollars a year going to come from if the deficit is not increased? The CBO estimates that the Federal Government’s FY2012 deficit is 1.1 trillion dollars (link). We would have to either eliminate ALL spending by the Federal Government (and we would still be short 140 billion dollars) or greatly increase taxes or some combination of both. How would this affect economic growth? How will this affect the cost of living?

2) If the deductions are capped at any of Romney’s made up numbers, this will add more money to government coffers to pay down the deficit. Even if the ‘made up number’ for maximum deductions allowed is zero because all the above tax deductions are eliminated, it will only add 653.7 billion dollars a year to Federal Government coffers. This still leaves 583.6 billion dollars a year that will need to be made up to be deficit neutral. How will this translate to a lower the cost of living? How could this not result in a huge, effective tax increase?

3) Additionally, if all the above deductions were eliminated then employers are paying more in taxes for health care, employees are paying more in taxes for pension contributions, homeowners are paying more in taxes to own a home and taxes to buy a home, employers are paying more for capital expenditures, tax payers are paying more for not getting breaks on state and local taxes, tax payers get no break from charitable contributions, foreign corporations are paying more taxes, capital gains are taxed more and folks with kids are paying more. How is this going to translate to a lower cost of living? How could this not result in a huge, effective tax increase?

4) If the 20%, across the board number goes away and no deductions are eliminated, there is still 7.4 trillion dollars for 10 years or 740 billion dollars a year that needs to be made up to be deficit neutral. Where will all this money come from? How will this not result in a huge, effective tax increase?

5) If the 20%, across the board number goes away and the Bush tax cuts are not extended and no deductions are eliminated, there is still 2 trillion dollars for 10 years or 200 billion dollars a year that needs to be made up to be deficit neutral. Where will all this money come from? Taxes will be increased with the Bush tax cuts going away.

6) If the 20%, across the board number goes away and the Bush tax cuts are not extended and the increased defense spending goes away and all above deductions are eliminated then that would pay off the deficit by 653.7 billion dollars a year. However, point 3 still applies, the cost of living goes up, taxes are increased with the Bush tax cuts going away and it makes Mitt Romney a liar.

Conclusion

Since I know that Romney could not lie or change his position, I can only conclude that my math is wrong.

Since I also know that an economist with superior math skills would not read such a lowly post as mine, I would ask that any regular ‘ol, internet hack like myself give me a few pointers about how I can improve my math (even smart ass comments will be treated with all due sincerity ;-).

————————————–

Notes and References:

CBO 5.4 trillion over 10 years for the Bush tax cuts link

Romney additional 20% across the board, reduce corporate income tax rate to 25%

Romney add 2 trillion over 10 years to defense spending

“Make up a number, $25,000, $50,000. Anybody can have deductions up to that amount,” he said. link

“The 10 biggest personal tax expenditures, which together account for 70 percent of all personal tax breaks, are as follows: the exclusion of employer health insurance, the exclusion of employer pensions, the mortgage interest deduction, the exclusion of medicare, lower capital gains rates, the earned income tax credit, the deduction of income taxes, the exclusion of capital gains taxes at death, the deduction of charitable contributions, and the deduction of employer benefits under cafeteria health plans.” link

“Governor Romney’s central economic plan calls for a $5 trillion tax cut — on top of the extension of the Bush tax cuts — that’s another trillion dollars” –President Obama

“”I don’t have a $5 trillion tax cut” –Governor Romney

How can both facts be true? The $5 trillion figure comes from the fact that Romney has proposed to cut tax rates by 20 percent and eliminate the estate tax and alternative minimum tax. The nonpartisan Tax Policy Center says that would reduce tax revenue by nearly $500 billion in 2015, or about $5 trillion over 10 years

But Romney also has said he will make his plan “revenue neutral” by eliminating tax loopholes and deductions, although he has not provided the details.

The Tax Policy Center has analyzed the specifics of Romney’s plan thus far released and concluded the numbers aren’t there to make it revenue neutral.” link

“Romney lays out his national security policy on his website. There, he warns that restoring the military “will not be a cost-free process,” and says he will “begin by reversing Obama-era defense cuts … with the goal of setting core defense spending — meaning funds devoted to the fundamental military components of personnel, operations and maintenance, procurement, and research and development — at a floor of 4 percent of GDP.”

What’s 4 percent worth?

The Pentagon’s budget is expected to run in the range of 3.2 to 3.5 percent of GDP in the next fiscal year. According to the Center for a New American Security, a group with ties to both Republican and Democratic administrations, even a gradual ramp up to 4 percent would increase defense spending by $2.1 trillion over the next ten years, as reported by CNN.

The Committee for a Responsible Federal Budget, a bipartisan group focused on deficit reduction, uses that number too, as do other budget think tanks. Romney seems to accept it, so as far as the $2 trillion figure goes, it seems reasonably accurate.” link

“The claim is based on a study done by the Tax Policy Center, a nonpartisan group that has analyzed the tax plans of the candidates. The center examined Romney’s proposals for a 20 percent reduction in all federal income tax rates, eliminating the Alternative Minimum Tax, eliminating the estate tax and other tax reductions.

The center estimated that altogether, the lost revenues would total $480 billion by 2015. The Obama campaign adds up the cost over a decade and winds up with $4.8 trillion, which it then rounds up to $5 trillion.

…

The most Romney has personally said is that he might cap deductions at $17,000″ link

“Reduce federal spending as a share of GDP to 20 percent – its pre-crisis average – by 2016.

Reduce individual marginal income tax rates across-the-board by 20 percent, while keeping current low tax rates on dividends and capital gains. Reduce the corporate income tax rate – the highest in the world – to 25 percent.

Broaden the tax base to ensure that tax reform is revenue-neutral.

Gradually reduce growth in Social Security and Medicare benefits for more affluent seniors. Give more choice in Medicare to improve value in health care spending.

Block grant the Medicaid program to states, enabling experimentation to better fit local situations.

Remove regulatory impediments to energy production and innovation that raise costs to consumers and limit job creation.

Repeal and replace the Dodd-Frank Act and the Patient Protection and Affordable Care Act. The Romney alternatives will emphasize better financial regulation and market-oriented, patient-centered health care reform.

Tax Reform.

A significant body of economic research concludes that fundamental tax reform could increase real GDP growth over the next decade by 0.5 to 1 percentage point per year. Kevin Hassett and Alan Auerbach surveyed the literature and found that tax reform could increase output by between 5 and 10 percent. (Auerbach, J., Alan, Kevin A. Hassett, Toward Fundamental Tax Reform, Washington, D.C.: The AEI Press, 2005). David Altig, AlanAuerbach, Laurence Kotlikoff, Kent Smetters and Jan Wallsier found that reform proposals would increase GDP by between 5 and 9 percent over the long run, using a dynamic economic simulation model. (Altig, David, Alan J. Auerbach, Laurence J. Kotlikoff, Kent A. Smetters, Jan Wallsier, “Simulating Fundamental Tax Reform in the U.S.,” University of California, Berkeley, September 29, 1999). Young Lee and Roger Gordon found that a cut in the corporate tax rate by10 percentage points would increase economic growth by 1.1 to 1.8 percent annually. (Lee, Young, Roger H. Gordon, “Tax Structure and Economic Growth,” University of California, San Diego, July 15, 2004)

More recently a study by John Diamond of Rice University estimated that the Romney tax reforms will raise real GDP by about 0.6 percent per year over a decade and increase employment in the long run (above the level possible in a more robust cyclical recovery) by 7million jobs. A long-term reform would also create a more stable tax code, which adds further gains in output by increasing policy predictability. The number of provisions of the tax code expiring each year has skyrocketed from 11 in 2000-2002 to 133 in 2010-2012. The epitome of the deviations from basic principles is the self-inflicted fiscal cliff where many important provisions of the tax code change at the end of 2012. Scott Baker, Nicholas Bloom, and Stephen Davis report the quantitative impact of this uncertainty (in their paper in

Government Policies and the Delayed Economic Recovery

edited by Lee Ohanian, John Taylor, and Jan Wright).One important feature of business taxation is the link between the taxation of unincorporated business income and the investment and employment decisions of unincorporated businesses. Using estimated effects of taxation from previous research, one can calculate the change in unincorporated business investment and employment as a result of the Romney program’s proposed lower marginal tax rates, as opposed to Obama’s proposed higher marginal tax rates.(See the research in Robert Carroll, Douglas Holtz-Eakin, Mark Rider, and Harvey S. Rosen, “Entrepreneurs, Income Taxes, and Investment,” in Joel Slemrod, ed., Does Atlas Shrug?: The Economic Consequences of Taxing the Rich. Cambridge: Harvard University Press, 2000; and Robert Carroll, Douglas Holtz-Eakin, Mark Rider, and Harvey S. Rosen, “Income Taxes and Entrepreneurs’ Use of Labor,” Journal of Labor Economics, April 2000.) Using similar research methods, the decline in the top effective rate in the Romney program raises the probability that a small business undertakes additional investment by 40 percent, and augments the capital outlays of those that do expand by 54 percent. As these expansionary incentives are put in place, the demand for capital goods will rise – a fundamental of strong economic growth. The decline in the top effective rate under the Romney program would raise the probability that a small business would add to payrolls by roughly 48 percent – a significant impact. Similarly, for those firms that do additional hiring, the growth in payrolls would be enhanced by over 14 percent. Insum, tax reform that reduces marginal tax rates would benefit workers by increasing hiring and wages.

Spending and Entitlement Reform.

Recent research by John Cogan and John Taylor of Stanford University and Volker Wieland and Maik Wolters of Goethe University estimates that the output effects of a fiscal consolidation, like the Romney plan, would gradually reduce federal spending relative to GDP. In a long-run model, the fiscal consolidation raises both investment and output(the latter by almost 2 percent). In an alternative model with short-run rigidities, the spending consolidation also raises output by about 2 percent. In both cases, output rises even in the short run, as households and businesses respond to lower expected future tax rates as a result of the fiscal consolidation.

Beneficial Effects of Tax Cuts Versus Temporary Stimulus Packages.

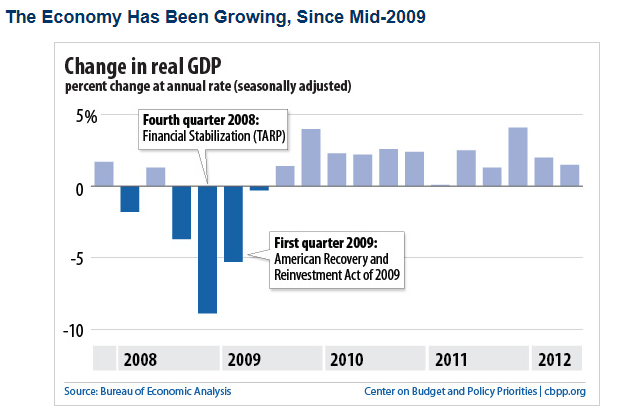

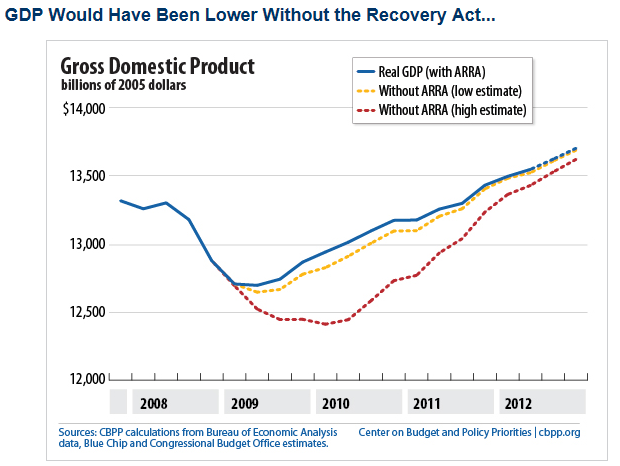

Recent research by Alberto Alesina and Silvia Ardagna of Harvard University argues that policies to increase economic growth are more effective if done with tax cuts than with spending increases. In their conclusion, they write about the Obama stimulus: “About two-thirds of this fiscal package is constituted by increases in spending, including public investment transfers, and government consumption. According to our results, fiscal stimuli based upon tax cuts are much more likely to be growth-enhancing than those on the spending side.” (See Alberto Alesina and Silvia Ardagna, “Large Changes in Fiscal Policy: Taxes versus Spending,” in Jeffrey Brown, ed., Tax Policy and the Economy, Cambridge: MIT Press, 2009.) Separate research by Andrew Mountford of the University of London and Harald Uhlig of Humboldt University concurs: “Our key finding isthat the best fiscal policy to stimulate the economy is a deficit-financed tax cut and that long-term costs of fiscal expansion through government spending are probably greater than the short-term gains.” (See Andrew Mountford and Harald Uhlig, “What Are the Effects of Fiscal Policy Shocks?,” CEPR Discussion Paper, July 2005.) Regulatory Reform.

Recent research by Ellen McGratten and Nobel laureate Edward Prescott concludes that higher regulatory costs reduced both R&D and fixed investment during the financial crisis and its aftermath; and regulations continue to increase. Between 2009 and 2010,the number of pages devoted to final rules in the Federal Register rose from 20,782 to a 24,914 – a 20 percent increase. Stopping this growth and applying cost benefit analysis will remove impediments to investment and increase long-term growth.

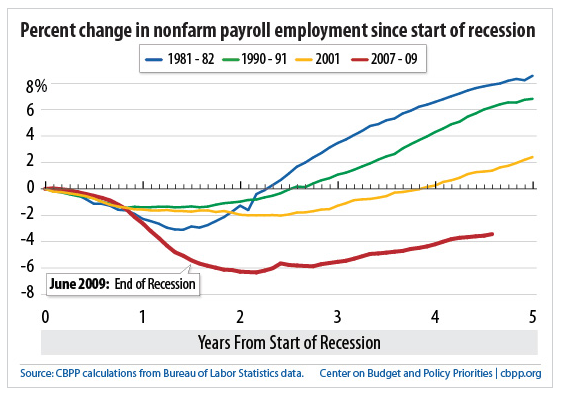

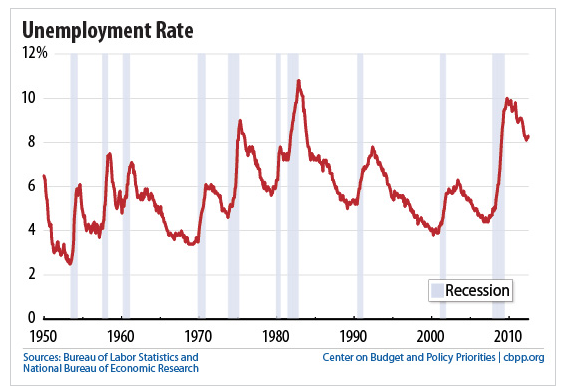

Historical Comparison to the Reagan Recovery.

One historical comparison is particularly relevant in this context – the recovery from the 1981-1982 recession. In the 1981-1982 recession, the unemployment rate soared to 10.8 percent. In the 2007-2009 recession, it peaked at 10 percent.”Both downturns were rooted in financial convulsions. The 1981-1982 recession was induced by restrictive monetary policy aimed at breaking the back of double-digit inflation and interest rates, which generated a housing and savings-and-loan crisis. The more recent recession resulted from excessive government intervention to increase homeownership by expanding subprime housing loans, on which substantial leverage was built. The resulting wave of defaults damaged the base of the banking system. Fifty-three months after the start of the 1981-1982 recession, total employment in the U.S. was up 7.5 million, or almost 7.5 percent higher than when the recession began. The labor-force participation rate rose to 65 percent from 63.8 percent, as optimism about the future pulled potential workers into the job market. Real per capita gross domestic product increased by $2,870, and was 11 percent higher than when the recession started. Fifty-three months after the start of the 2007-2009 recession, however, total employment in the United States is still down four million jobs, or 2.7 percent lower than when the recession began. The labor-force participation rate has dropped to 63.8 percent from 66 percent, as discouraged workers have exited the labor market. Real per capita GDP has declined by $964, and is 2.2 percent lower today than when the recession began. If the current economy had matched the job-creation rate of the recovery from the 1981-1982 recession, there would be 15 million more Americans at work today, 8.3 million more Americans would be in the labor force, and per capita GDP would be $5,792 higher than it is today.” (Phil Gramm and Glenn Hubbard, Op-Ed, “Gramm and Hubbard: What A Romney Recovery Might Look Like, “The Wall Street Journal, 06/06/12)Policy responses in the early 1980s aimed not just at overcoming the 1981-1982 recession, but at overcoming the structural problems of the 1970s. By reducing domestic discretionary spending, setting out a three-year program to reduce tax rates, and alleviating the regulatory burden, policymakers sought to make it profitable to invest in America again. These principles match those in the Romney plan. Governor Romney would reduce the size and cost of the federal government. He champions a reduction in marginal tax rates in the context of a general tax reform. Particularly powerful are his proposals to reduce marginal tax rates on business income earned by corporate and unincorporated businesses alike.” link